Channel samples include 2.0 metres @ 4.9% copper and 62 g/t silver

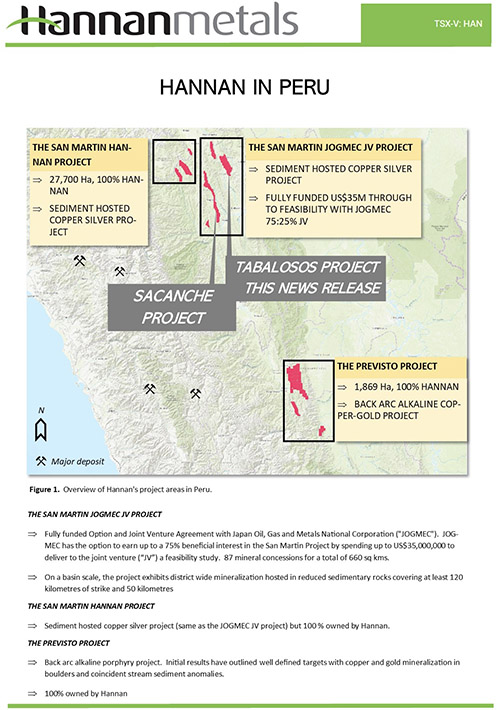

Vancouver, Canada – Hannan Metals Limited (“Hannan” or the “Company”) (TSXV: HAN) (OTCPK: HANNF) provides assay results from the first outcrop copper-silver discoveries from the Tabalosos project held within the San Martin JOGMEC JV sediment-hosted copper-silver project in Peru (Figures 1 and 2).

Highlights:

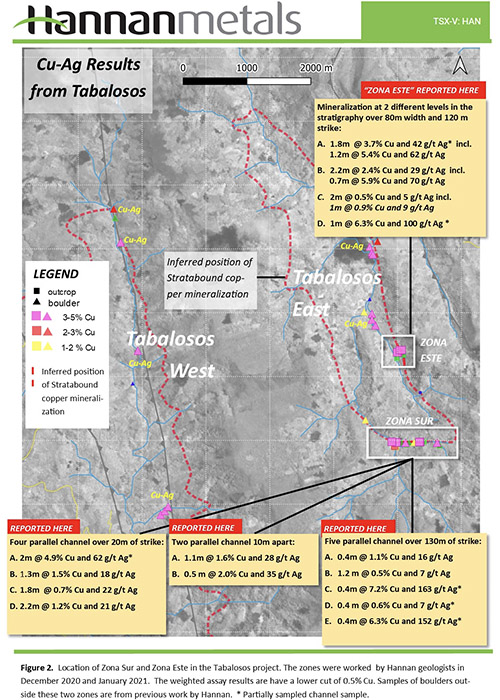

- First high grade copper-silver outcrop discoveries from the Tabalosos project held within the San Martin JOGMEC JV sediment-hosted copper-silver project in Peru. Outcrops have been delineated in two areas: Zona Este and Zona Sur that strike over a combined 2.5 kilometres. The discoveries were made by following up mineralized float samples in creeks found in 2019 by Hannan (Figure 2).;

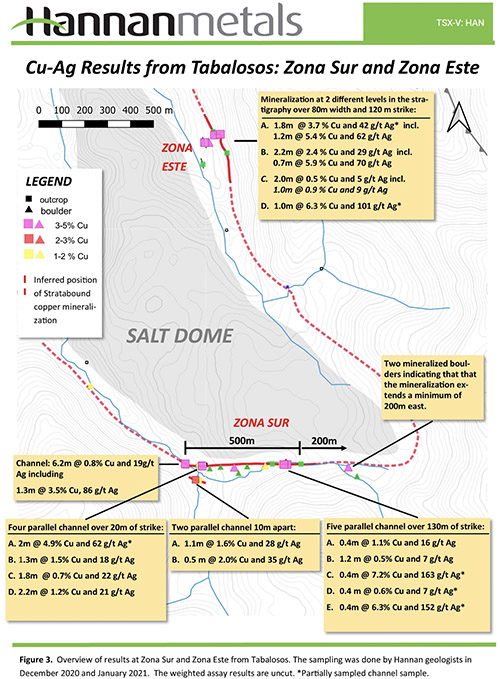

- Zona Sur consists of twelve channel-sampled outcrops over 500 metres of strike. Additional systematic sampling is required to determine the full width of mineralization. Best channel results include (Figure 3):

- 2.0 metres @ 4.9% copper and 62 g/t silver (partially sampled);

- 6.2 metres @ 0.8% copper and 19 g/t silver (full sample);

- including 1.3 metres @ 3.5% copper and 86 g/t silver;

- 0.4 metres @ 6.3% copper, 152 g/t silver (partially sampled);

- 0.4 metres @ 7.2% copper, 163 g/t silver (partially sampled);

- Zona Este consists of four channel-sampled outcrops within an area of 80 metres by 120 metres. Additional systematic sampling is required to determine the full width of mineralization. Best channel results include (Figure 3):

- 1.0 metre @ 6.3% copper and 101 g/t silver (partially sampled);

- 1.8 metres @ 3.7% copper and 42 g/t silver (partially sampled);

- including 1.2 metres @ 5.4% copper and 62 g/t silver

- 2.2 metres @ 2.4% copper and 29 g/t silver (full sample);

- including 0.7 metres @ 5.9% copper and 70 g/t silver

- Hannan continues to work with support and permission from all stakeholders at San Martin and interacts closely with local communities.

Michael Hudson, CEO, states: “San Martin continues to deliver high grade copper and silver at scale. These are the first high outcrop discoveries found by our team at Tabalosos, by undertaking good prospecting and geological work. Given the challenges in making surface discoveries with the predominant soil and colluvial cover, teams are now in the field collecting detailed and systematic soil samples to map and infill the mineralized horizon between outcrops over multiple kilometres.”

The San Martin Project is located in north-eastern Peru. Project access is excellent via a proximal paved highway, while the altitude ranges from 400 metres to 1,600 metres in a region of high rainfall and predominantly forest cover. Hannan has staked a total of 88 mineral concessions for a total of 65,600 ha (656 sq kms), covering multiple trends within a 120 km of combined strike for sedimentary-hosted copper-silver mineralization. A total of 43 granted mining concessions for 329 sq km have been granted, while the rest remain under application. The Tabalosos project is located 80 kilometres north of Sacanche where earlier work by Hannan at San Martin has identified a 20 kilometre strike trend which includes channel samples such as 2.0 metres @ 5.9% copper and 66 g/t silver, 0.6 metres @ 8.7% copper and 59 g/t silver and 3.0 metres @ 2.5% copper and 22 g/t silver.

The new outcropping mineralized discoveries have been delineated in two areas: Zona Este and Zona Sur that strike over a combined 2.5 kilometres (Figure 2, 3). Most of the outcropping areas are covered by colluvial cover that make it difficult to sample across the full width of mineralization and therefore additional systematic sampling is required, in many cases, to determine the full width of mineralization.

Zona Sur consists of twelve channel-sampled outcrops over 500 metres of strike, with earlier boulder discoveries extending the zone to a minimum of 700 metres strike (Figure 3). Zona Este consists of four channel-sampled outcrops within an area of 80 metres by 120 metres. Additional systematic sampling is required to determine the full width of mineralization in both areas. Better channel results include (Figure 3) are listed in Point 2 and 3 respectively of the highlights above and shown in Figures 2 and 3.

The new outcrop discoveries were made at the top of the Sarayaquillo Formation by following up mineralized float samples in creeks found in 2019 by Hannan that defined a 30 kilometre trend hosting copper-silver mineralization with four key zones defined over a 5 kilometre cross strike width. At Tabalosos two mineralized target styles have been defined by Hannan geologists:

- A stratabound position in the upper levels of the Sarayaquillo Formation, defined by the presence of debris organic material that hosts high-grade copper-silver mineralization. This zone is correlated over a 30- kilometre-long trend and over 5 kilometres in width across the Tabalosos project area and is the same mineralized stratigraphic level identified in outcrop at Sacanche, located 80 kilometres to the south.

- A structurally controlled sandstone hosted copper-silver target has been identified in the southern part of the project. This area is 7 kilometres long and up to 5 kilometres wide in Tabalosos.

Peru currently remains with COVID-19 lockdown restrictions, and Hannan’s field work was suspended, as a result, through February 2021. With COVID-safe work practices, including the establishment of a dedicated Hannan field base in Tarapoto, technical and social teams have been remobilized back into the field during the second week of March. Hannan’s number one priority is the health, safety and well-being of our employees, stakeholders and communities. We look forward to the opportunity to return to the field, and we will continue to support the San Martin communities while working to derisk and advance our knowledge of the vast mineral system emerging in the region. Hannan continue to work with support and permission from all stakeholders including local communities in San Martin.

About the San Martin JOGMEC JV Project (Copper-Silver, Peru, 88 mining concessions for 660 sq km)

On November 30, 2020 Hannan announced that it had signed a binding letter agreement for a significant Option and Joint Venture Agreement (the “Agreement”) with JOGMEC. Under the Agreement, JOGMEC has the option to earn up to a 75% beneficial interest in the San Martin Project by spending up to US $35,000,000 to deliver to the joint venture (“JV”) a feasibility study.

The Agreement grants JOGMEC the option to earn an initial 51% ownership interest by funding US $8,000,000 in project expenditures at San Martin over a four-year period, subject to acceleration at JOGMEC’s discretion. JOGMEC’s minimum commitment is to fund US $1,000,000 from April 1, 2020 to March 31, 2021 and JOGMEC has agreed to reimburse the Company for all project related costs from April 1, 2020. JOGMEC, at its election, can then earn:

- an additional 16% interest for a total 67% ownership interest by achieving either a prefeasibility study or funding a further US $12,000,000 in project expenditures in amounts of at least US $1,000,000 per annum (for a US $20,000,000 total expenditure); and,

- subject to owning a 67% interest, a further 8% interest for a total 75% ownership interest by achieving either a feasibility study or funding a further US $15,000,000 in project expenditures in amounts of at least US $1,000,000 per annum (for a US $35,000,000 total expenditure).

Should JOGMEC not proceed to a prefeasibility study or spend US $20,000,000 in total, Hannan shall have the right to purchase from JOGMEC for the sum of US $1, a two percent (2%) Participating Interest, whereby Hannan’s Participating Interest will be increased to fifty-one percent (51%) and JOGMEC’s Participating Interest will be reduced to forty-nine percent (49%). At the completion of a feasibility study, JOGMEC has the right to either:

- purchase up to an additional ten percent (10%) Participating Interest from Hannan Metals (for a total 85% maximum capped Participating Interest) at fair value as determined in accordance with internationally recognized professional standards by an agreed upon independent third-party valuator; or

- receive up to an additional ten percent (10%) Participating Interest from Hannan (for a total 85% maximum capped Participating Interest) in consideration of JOGMEC’s agreement to fund development of the project, by loan carrying Hannan until the San Martin Project generates positive cash flow.

After US $35,000,000 has been spent by JOGMEC and before a feasibility study has been achieved, both parties will fund expenditures pro rata or dilute via a standard industry dilution formula. If the Participating Interest in the Joint Venture of any party is diluted to less than 5% then that party’s Participating Interest will be automatically converted to a 2.0% net smelter royalty (“NSR”), and the other party may at any time purchase 1.0% of the 2.0% NSR for a cash payment of US $1,000,000. Hannan will manage exploration at least until JOGMEC earns a 51% interest, after which the majority participant interest holder will be entitled to act as the operator of the joint venture. Initial exploration activities will focus on the collection of the geological, geophysical, and geochemical datasets in the JV project areas. The first phase of exploration is expected to conclude March 2021.

Sediment-hosted stratiform copper-silver deposits are among the two most important copper sources in the world, the other being copper porphyries. They are also a major producer of silver. According to the World Silver Survey 2020 KGHM Polska Miedz’s (“KGHM”) three copper-silver sediment-hosted mines in Poland are the leading silver producer in the world with 40.2Moz produced in 2019. This is almost twice the production of the second largest producing mine. The Polish mines are also the sixth largest global copper miner and in 2018, KGHM produced 30.3 Mt of ore at a grade of 1.49% copper and 48.6 g/t silver from a mineralized zone that averages 0.4 to 5.5 metres thickness.

Technical Background

All samples were collected by Hannan geologists. Rock and sediment samples were transported to ALS in Lima via third party services using traceable parcels. At the laboratory rock samples were prepared and analyzed by standard methods. The sample preparation involved crushing 70% to less than 2mm, riffle split off 250g, pulverize split to better than 85% passing 75 microns. The crushers and pulverizes were cleaned with barren material after every sample. Samples were analyzed by method ME-MS61, a four acid digest preformed on 0.25g of the sample to quantitatively dissolve most geological materials. Analysis is via ICP-MS. Gold was analyzed using method Au-ICP22 on a 50g sample charge. The method uses fire assay and ICP-AES.

Channel samples are considered representative of the in-situ mineralization samples and sample widths quoted approximate the true width of mineralization, while grab samples are selective by nature and are unlikely to represent average grades on the property.

About Hannan Metals Limited (TSXV:HAN) (OTCPK: HANNF)

Hannan Metals Limited is a natural resources and exploration company developing sustainable resources of metal needed to meet the transition to a low carbon economy. Over the last decade, the team behind Hannan has forged a long and successful record of discovering, financing, and advancing mineral projects in Europe and Peru. Hannan holds 1,864 square kilometers (186,400 hectares) of granted mineral concessions and applications in Peru making it a top ten in-country explorer by area.

Mr. Michael Hudson FAusIMM, Hannan’s Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

| On behalf of the Board, "Michael Hudson" Michael Hudson, Chairman & CEO | Further Information www.hannanmetals.com 1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7 Mariana Bermudez, Corporate Secretary, +1 (604) 685 9316, info@hannanmetals.com |

Forward Looking Statements

Certain disclosure contained in this news release, including the Company’s expectations regarding the Agreement and the payments and earn-in upon the successful completion of certain milestones, may constitute forward-looking information or forward-looking statements, within the meaning of Canadian securities laws. These statements may relate to this news release and other matters identified in the Company's public filings. In making the forward-looking statements the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. These risks and uncertainties include but are not limited to the potential impact of epidemics, pandemics or other public health crises, including the current coronavirus pandemic known as COVID-19 on the Company’s business. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.