Vancouver, Canada – Hannan Metals Limited (“Hannan” or the “Company”) (TSX.V: HAN) (OTCPK: HANNF) is pleased to present an update on exploration completed for the last year and announce plans are underway for a major drilling program to test geological, seismic and soil targets on its Kilbricken zinc-lead-silver prospect near Ennis and on other prospects in the group’s extensive prospecting licence area in Co. Clare, Ireland.

Key points:

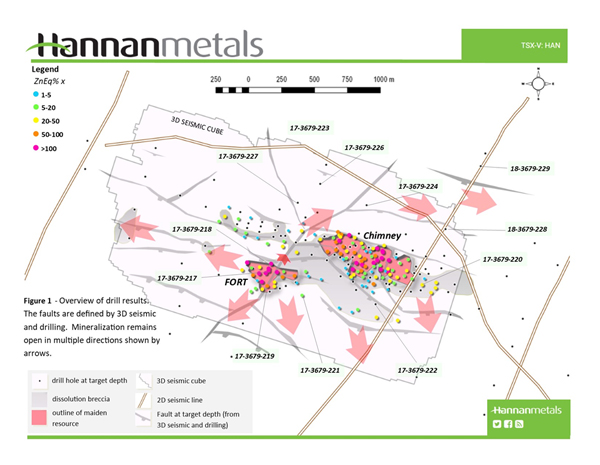

- Following a successful exploration program completed by Hannan over the last year, the Company is now planning a 20,000 metre drill program to test geological, seismic and soil targets generated both at Kilbricken and across Hannan’s large Clare prospecting licence. Immediate priorities on the regional basin-scale are structural trends evident in seismic data that coincide with seven significant geochemical targets within a 12 kilometre untested trend.

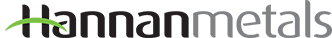

- Hannan’s first year diamond drill program comprised 12 holes for 6,492 metres and focused on expanding the Kilbricken resource. Many drill holes intersected significant mineralization which extended both the Fort and Chimney Zones (Tables 1-2, Figures 1-2). Drill highlights include DH 17-3679-217 (“DH217”) at the Fort Zone, that was one of the most mineralized ever drilled at the property:

- 8.0 metres @ 4.1% Zn, 33.7% Pb and 174 g/t Ag (37.9% Zn+Pb) from 528 metres;

- 3.4 metres @ 5.2% Zn, 4.3% Pb and 33 g/t Ag (9.5% Zn+Pb) from 570 metres;

- 26.6 metres @ 7.5% Zn, 0.9% Pb and 14 g/t Ag (8.4% Zn+Pb) from 588 metres;

- A maiden resource1 was established comprising 2.7 million tonnes at 8.8% zinc equivalent (“ZnEq”), including 1.4 million tonnes at 10.8% ZnEq indicatedAND inferred resources of 1.7 million tonnes at 8.2% ZnEq, including 0.6 million tonnes at 10.4% ZnEq. for Kilbricken, which immediately ranked it as one of the top ten base metal deposits in Ireland by tonnes and grade (data sourced from the Irish Exploration, Mining Division website);

- Close to 1,000 surface geochemical samples were collected which defined seven new anomalous areas within a 12km by 2km long north-west trending multi-element geochemical anomaly;

- A 40.6 line kilometre 2D seismic survey that delivered a critical new set of subsurface data across much of the Clare prospecting licence;

- Locked cycle metallurgical testwork on massive sulphide mineralization from Kilbricken is now underway with Wardell Armstrong with results available Q2 2018;

- Hannan has now made all cash payments totaling US$1,000,000 (€810,000) to Lundin Mining Ltd to complete its purchase of the project. Lundin will retain a 2% net smelter return royalty on all sales of mineral products extracted from the project area, subject to certain buy back provisions.

Mr Michael Hudson, Chairman & CEO states, “We are delighted with the progress we have made over the last year since listing. After completing our purchase from Lundin Mining we now own one of the few high-grade zinc-rich sulphide discoveries made over the last decade in Ireland within a strategically important, regional-scale land package. We have established a maiden resource estimate which our drilling has already expanded, while our seismic and geochemical work has unlocked the potential which will form the basis for current and future drilling targets.”

After raising a total of C$4.8M in February and August 2017, Hannan has quickly progressed to become one of Ireland’s leading exploration companies. The Irish midlands are a high pedigree zinc district, long favoured by major mining companies due to the presence of large high-grade deposits often with simple process flowsheets and high value low impurity concentrates. Hannan’s work to date at the Clare project has focused on the capture of new data, including extensive drilling, geological, seismic and geochemical work programs within its large prospecting licence package. The exploration team has completed all work safely, to plan, and to budget with full community cooperation, and is now planning for follow-up work on a range of resource expansion to regional scale targets with 20,000 metres of drilling, which remains subject to further financings during 2018/19.

Twelve holes have been completed by Hannan at Kilbricken for a total of 6,492 metres over the last year. Since discovery of the Kilbricken resource ten years ago, total drilling on the project comprises 163,017 metres with an estimated US$30,000,000 spent on exploration.

Hannan’s drilling initially focused on expanding the resource at Kilbricken with the many holes intersecting significant mineralization and extending both the Fort and Chimney Zones (Figures 1-2). The true thickness of mineralized intervals at Kilbricken is interpreted to be greater than 95% of the sampled thickness. Drill highlights include:

DH 17-3679-217 (“DH217”) at the Fort Zone, one of the most mineralized ever drilled at the property:

- 8.0 metres @ 4.1% Zn, 33.7% Pb and 174 g/t Ag (37.9% Zn+Pb) from 528 metres, including 3.2 metres @ 8.4% Zn, 72.8% Pb and 388 g/t Ag (81.2% Zn+Pb) from 528 metres;

- 3.4 metres @ 5.2% Zn, 4.3% Pb and 33 g/t Ag (9.5% Zn+Pb) from 570 metres;

- 26.6 metres @ 7.5% Zn, 0.9% Pb and 14 g/t Ag (8.4% Zn+Pb) from 588 metres, including18.8 metres @ 8.8% Zn, 1.1% Pb, 19 g/t Ag (9.9% Zn+Pb) from 588 metres;

DH 17-3679-218 (“DH218”), drilled at Fort Zone intersected massive sulphides within a down-hole thickness of 55 metres:

- 4.0 metres @ 0.7% Zn, 8.9% Pb and 31 g/t Ag (8.6% ZnEQ) from 526 metres, including 1.4 metres @ 1.6% Zn, 15.2% Pb and 53 g/t Ag from 526 metres and 1.0 metres @ 0.4% Zn, 13.8% Pb and 46 g/t Ag from 529 metres;

- 6.0 metres @ 2.5% Zn, 1.8% Pb and 13 g/t Ag (4.4% ZnEQ) from 544 metres, including 2.1 metres @ 5.0% Zn, 3.7% Pb and 25 g/t Ag from 548 metres;

- 6.4 metres @ 4.8% Zn, 1.3% Pb and 15 g/t Ag (6.3% ZnEQ) from 558 metres, including 1.1 metres @ 13.3% Zn, 3.1% Pb, 34 g/t Ag from 558 metres;

- 10.0 metres @ 3.4% Zn, 1.0% Pb and 13 g/t Ag (4.7% ZnEQ) from 571 metres;

DH 17-3679-219 (“DH219”), a 50 metre step out hole from the Fort Zone intersected massive sulphide mineralization within a total down-hole thickness of 92.9 metres:

- 8.4m @ 8.0% ZnEQ (6.2% Zn, 0.9% Pb, 15 g/t Ag and 0.35% Cu) from 599.0m, including 1.4m @ 20.8% ZnEQ (16.8% Zn, 3.5% Pb, 30 g/t Ag, 0.2% Cu) from 604.0m

- 12.8m @ 5.1% ZnEQ (3.2% Zn, 1.8% Pb, 13g/t Ag and 0.05% Cu) from 631.5m, including 0.9m @ 17.8% ZnEQ (15.3% Zn, 2.1% Pb, 25 g/t Ag, 0.1% Cu) from 643.4m

DH 17-3679-220 (“DH220”) first drill hole to test along strike from the Chimney Zone, was a 75 metre step out:

- 3.3m @ 10.4% ZnEQ (3.6% Zn, 6.5% Pb, 58 g/t Ag and 0.1% Cu) from 477.0m, including 1.0m @ 18.6% ZnEQ (3.7% Zn, 14.5% Pb, 121 g/t Ag, 0.2% Cu) from 478.6m

The remaining eight drill holes of the 2017 program (DH 17-3679-221 through to DH 17-3679-229; DH 17-3679-225 was abandoned at 72 metres) (see Tables 1 and 2 and Figure 1) were drilled outside the Kilbricken resource area, based primarily on soil anomalies. Hole 17-3679-221 intersected anomalous copper mineralization 300 metres along strike from the Fort Zone. Hole 17-3679-226, drilled up dip from the resource area, intersected hematite alteration which is considered a good indicator of proximity to mineralization. Drill hole 17-3679-228 contained both pyrite at the base of reef with intense dolomitization and a fault in the stratigraphic footwall, which indicates a drill target at shallower levels up-dip of from the resource area. The remaining five holes did not intersect significant mineralization or alteration (Figure 1).

A maiden resource1 estimate was calculated for the Kilbricken project by Hannan using drill hole data acquired prior to Hannan’s involvement in the project. A total indicated mineral resource of 2.7 million tonnes at 8.8% zinc equivalent (“ZnEq”), including 1.4 million tonnes at 10.8% ZnEq and a total inferred mineral resource of 1.7 million tonnes at 8.2% ZnEq, including 0.6 million tonnes at 10.4% ZnEq was calculated. This resource estimate immediately ranks Kilbricken as one of the top ten base metal deposits discovered in Ireland by tonnes and grade (data sourced from the Irish Exploration, Mining Division website);

Geochemical sampling grids at Hannan’s Clare County project now cover >200 km2 with a soil sample spacing of 500m x 250m (Figure 2). Over the Kilbricken prospect, a 30 km2 area was covered with a denser grid with 250m x 250m spaced samples. Recent sampling by Hannan now comprises a total of 961 samples and has defined seven new anomalous areas, including a 12km by 2km long north-west trending multi-element geochemical anomaly. Within this trend there are four Kilbricken-sized multi-point anomalies which have never been drill tested, including a southerly extension to the Ballyhickey historic mine (Figure 2).

Late in 2017 a 40.6 line kilometre 2D seismic survey was carried out on the Company’s 100%-owned County Clare zinc project, which hosts the Kilbricken zinc-lead-silver deposit in Ireland. The regional seismic survey is a first for the area and has delivered a critical new set of subsurface data across Hannan’s 35,444 hectare prospecting licence (Figure 1), which will form the basis for current and future drill targeting and prioritization. Combined with earlier surveys Hannan now owns 68 kilometres of 2D seismic and a 1.5 square kilometre 3D seismic survey. Hannan has also invested considerable time processing historic seismic data acquired in 2011 and 2012 by earlier operators, to further refine the structural architecture on the project.

Hannan commenced locked cycle metallurgical testwork utilizing the services of Wardell Armstrong late in 2017 and results will be available during Q2 2018. During 2017 the Company announced the results of a gap analysis on mineralogical investigations on the Kilbricken project, Ireland by Dr. Kurt Forrester of Arn Perspective Ltd. Based on this study and the available information, it is likely a conventional lead-zinc flotation circuit at Kilbricken should produce a saleable mineral concentrate.

The Company also commenced a formal technical collaboration and agreement with iCRAG at the University College Dublin during 2017. iCRAG is an EU and industry funded research centre with experts in Irish mineral deposits which will aid in geological understanding and targeting of additional mineralization on Hannan’s Clare licences.

Hannan has now made all cash payments totaling US$1,000,000 to Lundin Mining Ltd to complete its outright purchase of the project. The project was assigned to Hannan, and was acquired, effective September 21, 2016, pursuant to an Assignment Agreement between the Irish Minister for Communications, Climate Action and Environment, Hannan and Lundin Mining Exploration Limited (“Lundin”), a subsidiary of Lundin Mining Corporation (TSX:LUN). Under a separate Asset Purchase Agreement, dated June 3, 2016, Hannan purchased all exploration data associated with the project from Lundin for a cash payment of US$150,000. Hannan has now made two additional cash payments to Lundin of US$425,000 each in September 2017 and March 2018. Lundin will retain a 2% net smelter return royalty on all sales of mineral products extracted from the project area, subject to a 0.5% buy back right of Hannan for US$5,000,000, which must be exercised within one year from the date of commercial production. Hannan is required to pay Lundin a one-time bonus payment of US$5,000,000 within the earlier of (i) Hannan Ireland’s decision to proceed with mine construction or (ii) within 90 days of the establishment of a commercial financing to finance capital costs for mine construction.

About Hannan Metals Limited (TSX.V:HAN) (OTCPK: HANNF)

Hannan Metals Limited has 100% ownership of the County Clare Zn-Pb-Ag-Cu project in Ireland, which consists of 9 prospecting licences for 35,444 hectares. Zinc remains in tight supply amidst rising demand and stagnant supply. Ireland is a leading global jurisdiction for zinc mining and exploration. In 2015, Ireland was the world’s 10th largest zinc producing nation with 230,000 tonnes produced.

The maiden mineral resource1, dated July 10, 2017, immediately ranked Kilbricken as one of the top ten base metal deposits discovered in Ireland by tonnes and grade. Total indicated mineral resources were calculated as 2.7 million tonnes at 8.8% zinc equivalent (“ZnEq”), including 1.4 million tonnes at 10.8% ZnEq and total inferred mineral resources of 1.7 million tonnes at 8.2% ZnEq, including 0.6 million tonnes at 10.4% ZnEq.

Over the last decade, the team behind Hannan has forged a long and successful record of financing and discovering mineral projects in Europe. Additionally, the team holds extensive zinc experience, gained from the world’s largest integrated zinc producer of the time, Pasminco Ltd.

Mr. Michael Hudson FAusIMM, Hannan’s Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

NI 43-101 Technical Report:

On August 22, 2017, Hannan filed an independent National Instrument 43-101 Technical Report (the “NI 43-101 Technical Report”) on The Mineral Resource Estimate for the Kilbricken Zinc-Silver-Lead-Copper Project Co. Clare, Ireland For Hannan Metals Ltd in support of the Company’s news release dated July 10, 2017. The NI 43-101 Technical Report was authored by Mr. Geoff Reed of Reed Leyton Consultants and Dr. John Colthurst who are independent “qualified persons” as defined by National Instrument 43-101. The NI 43-101 Technical Report may be found under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at www.hannanmetals.com.

On behalf of the Board, "Michael Hudson" |

|

Forward Looking Statements

Certain information set forth in this news release contains “forward-looking statements”, and “forward- looking information” under applicable securities laws. Except for statements of historical fact, certain information contained herein constitutes forward-looking statements, which include the Company’s expectations regarding future performance based on current results, expected cash costs based on the Company’s current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause the Company’s actual performance and financial results in future periods to differ materially from any projects of future performance or results expressed or implied by such forward-looking statement. These risks and uncertainties include, but are not limited to: The Company’s expectations regarding the current drill program, liabilities inherent in mine development and production, geological risks, the financial markets generally, and the ability of the Company to raise additional capital to fund future operations. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Table 1: Highlight intersections Hannan first year of drilling at the Kilbricken Project, Clare, Ireland.

Lower cut-off 3% ZnEq.

HOLE | From | To | Width (m) | Zn% | Pb% | Ag ppm | Cu% | ZnEq% | Date Reported | |

DH217 |

| 528.0 | 536.0 | 8.0 | 4.1 | 33.7 | 174 | 0.1 | 35.8 | |

| incl. | 528.0 | 531.2 | 3.2 | 8.4 | 72.8 | 388 | 0.1 | 76.9 | |

|

| 570.0 | 573.4 | 3.4 | 5.2 | 4.3 | 33 | 0.1 | 9.6 | |

|

| 588.0 | 614.6 | 26.6 | 7.5 | 0.9 | 14 | 0.1 | 8.7 | |

| incl. | 588.0 | 606.8 | 18.8 | 8.8 | 1.1 | 19 | 0.1 | 10.3 | |

|

| 622.6 | 656.4 | 33.8 | 0.0 | 0.1 | 11 | 0.3 | 0.9 | |

DH218 | 526.0 | 530.0 | 4.0 | 0.7 | 8.9 | 31 | 0.0 | 8.6 | ||

incl. | 526.0 | 527.4 | 1.4 | 1.6 | 15.2 | 53 | 0.0 | 15.2 | ||

| incl. | 529.0 | 530.0 | 1.0 | 0.4 | 13.8 | 46 | 0.0 | 12.8 | |

| 544.0 | 550.0 | 6.0 | 2.5 | 1.8 | 13 | 0.0 | 4.4 | ||

| incl. | 547.9 | 550.0 | 2.1 | 5.0 | 3.7 | 25 | 0.1 | 8.7 | |

| 557.6 | 564.0 | 6.4 | 4.8 | 1.3 | 15 | 0.1 | 6.3 | ||

| incl. | 557.6 | 558.7 | 1.1 | 13.3 | 3.1 | 34 | 0.1 | 16.9 | |

| 571.2 | 581.2 | 10.0 | 3.4 | 1.0 | 13 | 0.1 | 4.7 | ||

DH219 |

| 599.0 | 607.4 | 8.4 | 6.2 | 0.9 | 15 | 0.4 | 8.0 | |

| incl. | 604.0 | 605.4 | 1.4 | 16.8 | 3.5 | 30 | 0.2 | 20.8 | |

|

| 631.5 | 644.3 | 12.8 | 3.2 | 1.8 | 13 | 0.1 | 5.1 | |

| incl. | 643.4 | 644.3 | 0.9 | 15.3 | 2.1 | 25 | 0.1 | 17.8 | |

DH220 |

| 477.0 | 480.3 | 3.3 | 3.6 | 6.5 | 58 | 0.1 | 10.4 | |

| incl. | 478.6 | 479.5 | 1.0 | 3.7 | 14.5 | 121 | 0.2 | 18.6 |

Note 1: The zinc equivalent (ZnEq) value was calculated using the following formula: ZnEq% = Zn % + (Cu% * 2.102) + Pb% * 0.815) + (Ag g/t * 0.023) with assumed prices of Zn $2587/t; Cu $5437/t; Pb $2108/t and Ag $18.44/oz.

Table 2: Collar Information for Resource Expansion Program at the Kilbricken Project (Irish National Grid)

HoleID | East | North | Azimuth | Dip | RL | Depth (m) |

DH217 | 139133 | 176006 | 020 | -82 | 22.433 | 714 |

DH218 | 139165 | 176035 | 010 | -81 | 22.735 | 651 |

DH219 | 139168 | 175979 | 0 | -90 | 22.443 | 762.4 |

DH220 | 140340 | 176010 | 182 | -85 | 24.245 | 530 |

DH221 | 139303 | 175861 | 075 | -80 | 20.34 | 763.4 |

DH222 | 139843 | 175739 | 054 | -71 | 26.83 | 550 |

DH223 | 139534 | 176698 | 020 | -55 | 24.373 | 190 |

DH224 | 139863 | 176457 | 25 | -65 | 23.417 | 379.5 |

DH225 | 139520 | 176659 | 200 | -75 | 22 | 72 |

DH226 | 139520 | 176659 | 30 | -75 | 22 | 417 |

DH227 | 139400 | 176540 | 0 | -80 | 20.277 | 393 |

DH228 | 140421 | 176300 | 45 | -65 | 25.804 | 375 |

DH229 | 140938 | 176857 | 270 | -55 | 38.93 | 360 |