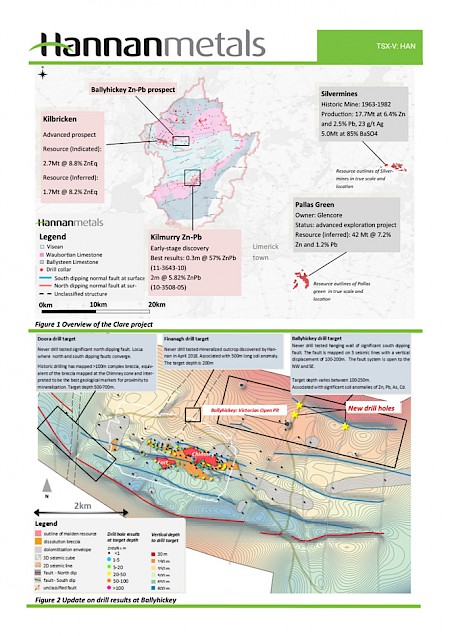

Vancouver, Canada – Hannan Metals Limited (“Hannan” or the “Company”) (TSXV: HAN) (OTCPK: HANNF) is pleased to provide an update on the diamond drilling program underway within Hannan’s 100% owned Clare zinc project in Ireland (see Hannan news release October 3, 2018 and Figure 1).

Key Points:

- Three holes for 735 metres have now been completed at the Ballyhickey prospect (Figure 2), located 2 to 3 kilometres north of the Kilbricken resource area;

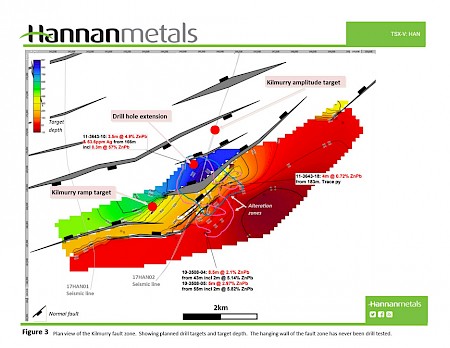

- Drilling now moves to the recently defined Kilmurry target, located 9 kilometres south of Hannan’s Kilbricken resource (Figure 1). Kilmurry is a seismic-defined structural and stratigraphic target mapped over >10 kilometres strike and 2 kilometres width (Figure 3). The hanging wall of the fault, that is an equivalent setting to all zinc mineralization in the Irish Midlands, has never been drill tested. Drilling will recommence at Kilmurry within the next 2 months once drill permitting is complete;

- The three holes completed at Ballyhickey were drilled on broad 300 - 1,300 metre spacings along a seismic defined structure, up-dip from an historic Victorian-age base metal mine. Although assays have not yet been received, drill holes did not intersect prospective geological features or visible mineralization.

Michael Hudson, Chairman and CEO states, “Kilmurry is a compelling target that has all the right ingredients for a major base metal system. Our on-going seismic interpretation recently identified a major syn-sedimentary structure, that we were excited to find had no prior drill testing, but nearby holes included widespread anomalous zinc and lead and a thin massive sulphide interval. Now that we have downgraded the prospectivity of the Ballyhickey prospect with three holes, our drill priorities for the new year now move to Kilmurry, where the scale of untested fault and host rock point to the potential for a transformative discovery.”

The Kilmurry area is highly prospective for zinc-lead mineralization because:

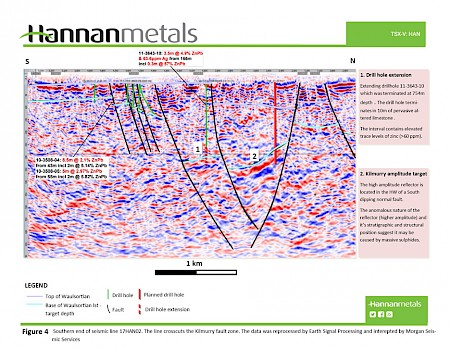

- The recently seismic defined north-dipping Kilmurry synsedimentary fault has one of the largest basin-scale displacements (>750 metres) mapped in Ireland (Figures 4 and 5);

- Drillholes adjacent to this fault show both extensive development of fault scarp debris material suggesting the Kilmurry fault was active during sedimentation; and

- The presence of significant mineralization, dissolution textures and alteration in the footwall position, including 0.3m @ 56% Zn+Pb at 166m depth (11-3546-10);

Three drill targets have been prioritized at Kilmurry (Figure 3, 4 and 5), the first of which lies in the hanging wall of the Kilmurry fault and will be tested by extending previous drillhole 11-3546-10 by 200 - 250 metres. This hole was terminated short of target in 2011 by earlier workers at 754 metres. The drill hole ends with 3 to 4 times background levels of zinc (>60 ppm) in highly altered limestone and intersected thin, but high-grade mineralization within the upper reef zone.

Other drill targets include a fault relay zone defined by two seismic lines, historic drilling and a recent 170 station gravity survey acquired by Hannan. This target is analogous to both the high-grade mineralization position observed at the Silvermines and Lisheen mines in Ireland and lies at a target depth of 400 - 600 metres. The third target to test is an anomalous high amplitude seismic reflector located in the hanging wall of a south dipping normal fault (Figures 4 and 5). The anomalous higher amplitude of the reflector is caused by geological contrasts, and its stratigraphic and structural position suggest it may be due massive sulphides.

About Hannan Metals Limited (TSX.V:HAN) (OTCPK: HANNF)

Hannan Metals Limited has 100% ownership of the County Clare Zn-Pb-Ag-Cu project in Ireland, which consists of 9 prospecting licences for 32,223 hectares. Zinc remains in tight supply amidst rising demand and stagnant supply. Ireland is a leading global jurisdiction for zinc mining and exploration.

This maiden mineral resource for Kilbricken was published in July 2017, and immediately ranks Kilbricken as one of the top ten base metal deposits discovered in Ireland by tonnes and grade. Total indicated mineral resources were calculated as 2.7 million tonnes at 8.8% zinc equivalent (“ZnEq”), including 1.4 million tonnes at 10.8% Zneq and total inferred mineral resources of 1.7 million tonnes at 8.2% ZnEq, including 0.6 million tonnes at 10.4% ZnEq. Importantly, the initial resource is expandable at all scales, from near resource to prospect scale.

Over the last decade, the team behind Hannan has forged a long and successful record of financing and discovering mineral projects in Europe. Additionally, the team holds extensive zinc experience, gained from the world’s largest integrated zinc producer of the time, Pasminco Ltd.

Mr. Michael Hudson FAusIMM, Hannan’s Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

NI 43-101 Technical Report:

On August 22, 2017, Hannan filed an independent National Instrument 43-101 Technical Report (the “NI 43-101 Technical Report”) on The Mineral Resource Estimate for the Kilbricken Zinc-Silver-Lead-Copper Project Co. Clare, Ireland For Hannan Metals Ltd in support of the Company’s news release dated July 10, 2017. The NI 43-101 Technical Report was authored by Mr. Geoff Reed of Reed Leyton Consultants and Dr. John Colthurst who are independent “qualified persons” as defined by National Instrument 43-101. The NI 43-101 Technical Report may be found under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at www.hannanmetals.com. The zinc equivalent (ZnEq) value was calculated using the following formula: ZnEq% = Zn % + (Cu% * 2.102) + Pb% * 0.815) + (Ag g/t * 0.023) with assumed prices of Zn $2587/t; Cu $5437/t; Pb $2108/t and Ag $18.44/oz.

On behalf of the Board, "Michael Hudson" | Further Information |

Forward Looking Statements

Certain information set forth in this news release contains “forward-looking statements”, and “forward- looking information” under applicable securities laws. Except for statements of historical fact, certain information contained herein constitutes forward-looking statements, which include the Company’s expectations regarding future performance based on current results, expected cash costs based on the Company’s current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause the Company’s actual performance and financial results in future periods to differ materially from any projects of future performance or results expressed or implied by such forward-looking statement. These risks and uncertainties include, but are not limited to: The Company’s expectations regarding the current drill program, liabilities inherent in mine development and production, geological risks, the financial markets generally, and the ability of the Company to raise additional capital to fund future operations. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.